Here’s a true but little known story about me....I decided to attend Virginia Tech after I visiting a family friend who was a student there.

Here’s a true but little known story about me....I decided to attend Virginia Tech after I visiting a family friend who was a student there.

Diane took me to a frat party and I had fun...a lot of fun...and VT zoomed up to my top college choice, thanks to my "punch"-influenced impressions. (Fortunately, the gods were with me, because VT turned out to be a great choice for me career- and otherwise.)

I bring up the story, though, because it reminds me of what's happening in social media...where execs are being asked wing social media decisions based on impressions. Social media initiatives provide real-world benefits -- but execs can and should expect to consider their economic value relative to other customer-facing initiatives.

Yes, it's hard to determine a social media ROI because of the combination of a long-term investment and unknown variables. But...

Not having a clear idea of how to determine a social media ROI doesn't mean it can't be done.

Want to know how? Think like an upstream oil company.

Yes, really.

Uncertainty in the oil industry

In the exploration petroleum business, geoscientists interpret discrete data from subsurface cross-sections of the earth, coupled with data from pin-cushioned well bores separated miles apart to determine viable oil and gas prospects.

Given the nature of the data and its plethora of unknowns, petroleum exploration carries a high uncertainty. However, geoscientists use of the data they do have to make estimates of a prospect’s reserve potential despite the uncertainty.

To compensate for the uncertainty, though, geoscientists couple their estimates with Chances of Success (COS) of finding economic reserves. The COS allows executives to give due consideration to the risk associated with a prospect and put the risk-return of a prospect it into context with others in the investment portfolio.

Engineers then determine the likely ROI for the prospect, also despite the unknowns. Inherent in the economic valuation is the time value of the long-term investment required to fully explore a prospect, as well as the technological demand of production required to extract any oil and gas.

All this long-term investmentness and dealing with unknownness sounds similar to the situation with social media valuation, doesn't it?

A social media approach to economic valuation with uncertainty

What social media folks can learn from the oil industry is to evaluate the potential impact of social media on a company despite the unknowns and associate the potential with the chance of success of achieving those results.

The combination of results and risk can then be used in the determination of social media’s ROI.

Simply stated, the more unknowns and then the lower the chance of success. And of course the opposite is true too. The fewer the unknowns, that is the more available metrics data, then the higher the chance of success of achieving a calculated return.

Consider a range of returns rather than a single point…

Another take away from the oil industry is to look upon social media potential over a range rather than a single point.

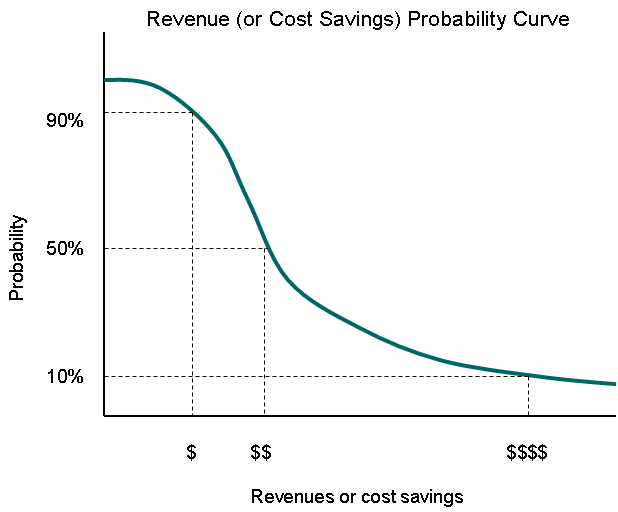

Determine the minimum, most likely and maximum cases and the chance of success for each case. Here’s a simple example for a social media valuation from a marketing perspective:

- Min case = 90% probability social media will generate X increased leads leading to $ additional revenues.

- ML case = 50% probability social media will generate X+Y increased leads leading to $$ additional revenues.

- Max case = 10% probability social media will lead to X+Y+Z leads and $$$$ additional revenues.

Flipping it around towards a customer service focus, the example becomes:

- Min case = 90% probability social media will generate X fewer service calls leading to $ in cost savings.

- ML case = 50% probability social media will generate X+Y fewer service calls leading to $$ in cost savings.

- Max case = 10% probability social media will lead to X+Y+Z fewer service calls and $$$$ in cost savings.

The graph below shows the Probability versus Revenue (or Cost Savings) Curve.

You’ll notice the minimum case will contribute the smallest amount of revenues (or cost savings) to the corporate coffers because it carries a high probability of achieving the stipulated results. Said another way, it also carries the lowest risk.

As the name implies, the most likely case is what you believe your social media initiative will most likely achieve and the risk is carries is mid-range.

In contrast, the P10 case has a low probability of occurring but it carries a high return on revenues. It’s carries a “woo hoo” result for the company.

As a rule of thumb, a company should not move forward on social media unless at least the P90 case is economic – and really, most companies will not want to move forward unless the P50 case is too.

Quantifying metrics into revenues or cost savings

How do you quantify “leads” in each case? Look to your historical metrics and use them as a springboard to conversion expectations. Or if you’re looking towards social media as to bolster your service channels, look to your call center metrics.

I wrote about factors to consider in your ROI calculation in my article How to calculate the ROI on collaboration software – Building the business case.

Might you have to make some assumptions in all this? Sure. Be upfront about it and it will give execs context for your ROI determination.

Remember to include…

As part of your overall social media initiative, you need to consider resource demands for staffing, technology, etc. That means evaluating the cost for those resources as part of your economic valuation of social media.

Related articles

How to calculate the ROI on collaboration software – Building the business case

Resources required to maintain your successful online community

The real Value of B2B blogging

The Great Social Media and Social CRM debates

Other thought leaders

Olivier Blanchard's Basics of Social Media ROI presentation (Follow Olivier on Twitter via @thebrandbuilder).

Andrew Mueller - How to Measure Success with Social Media – ROI vs Trending Metrics (Follow Andrew on Twitter via @andrewmueller).

Summary

Here’s the like it or not reality.

Any exec worth his salt will demand to know an expected ROI on any social media initiative – just like they will for any customer-facing initiative up for consideration. Besides which, every corporate initiative should translate into money in pocket for the corporation – it’s the raison d'être of business.

So it’s not going to fly to say determining the ROI is “too hard.” And talking in terms of metrics isn’t enough either because the “I” in ROI is always, always about money.

Still don't believe me? Try this on for size. Your broker calls you and recommends you invest in CoolioCo. You ask how much you can expect to earn. He says, "It's hard to say for sure, but trust me, your return will be great. Just super duper." Are you going to pull out your checkbook?

Didn't think so.

Why then would anyone expect an exec to be any different when looking over the field of corporate investment possibilities? Like it or not, the social media ROI thing needs to be figured out.

What would help you?

What makes determining the social media ROI hard for you? Or conversely, what would make it easier to get your hands around it?

Let me know in the comments or drop me an email (the contact form comes to me) and I'll try to find answers to make it easier for you.

Stay in touch with free updates

If information on the business and technology side of social media is valuable to you, then be sure to sign up to receive email content from me.

These are regular topics of discussion on Community Network. Additionally, I'm working on putting together courses focused on just those very things.

You'll want to be sure to stay in the loop.

One last thing…

If you ever meet my mother, ix-nay on my college selection process, 'k?